9 DIVIDEND STOCKS I Own Right Now

I'm excited to share 9 dividend stocks that I own, that I almost sold, (but I decided to keep). Many of these smaller dividend stock positions are true gems in my portfolio, in my humble opinion. Others are ones that I'd probably sell if I ever needed capital.

#dividend #stock #investing

Timestamps:

0:00 Introduction

0:44 I considered selling all 9 of these positions recently, because they are smaller positions in my portfolio.

2:14 SEGMENT 1: 9 DIVIDEND STOCKS I OWN THAT I CONSIDERED SELLING

2:33 Check out the pinned comment for a link to my Patreon.

3:06 These 9 stocks comprise 6.10% of my portfolio's value, and 5.50% of dividend income.

3:30 SEGMENT 2: BREAKDOWN OF THE 9 STOCKS

3:34 DIVIDEND STOCK 1: Caterpillar (CAT) 1.2% of my portfolio

4:36 Forward PE is in 13s

4:56 Starting dividend yield 2.11%

5:23 CAT's fundamentals (and share appreciation) have vastly outperformed my expectations.

6:16 DIVIDEND STOCK 2: Walmart (WMT) 1.1% of my portfolio

6:37 5Year Dividend CAGR only 1.9%

7:33 There is a tax impact to selling. And, I like to balance gains and losses.

8:05 Emotional investing It's one of my first positions owned

9:17 DIVIDEND STOCK 3: BP (BP) 1.0% of my portfolio

10:18 Forward PE of 6

10:23 Huge 4.9% dividend yield

10:45 I see the energy sector as a hedge, as a form of diversification

11:44 DIVIDEND STOCK 4: IBM (IBM) 0.9% of my portfolio

12:26 4.97% dividend yield

12:30 Technology exposure

13:13 If I ever had to raise capital again, IBM would be at the top of my sell list.

13:51 DIVIDEND STOCK 5: Utz Brands, Inc. (UTZ) 0.50% of my portfolio

14:15 I considered all of my small stocks, because they take up mindshare.

14:35 I don't mind having overexposure to snack foods, because it's a great category that I understand.

15:07 Forward PE of 30, due to quick growth

15:15 2year dividend CAGR of 6.8%

15:40 Small cap, highgrowth stock

16:18 DIVIDEND STOCK 6: Carrier (CARR) 0.50% of my portfolio

16:25 CARR is one of my highperformers, of course I could not sell.

16:32 3Year Dividend CAGR of 32.2%

17:16 United Technologies used to be one of my favorite positions. I'm holding the spinoffs and managing it all as 1.

18:08 Carrier is way off the list, no way I would sell.

18:18 DIVIDEND STOCK 7: Otis (OTIS) 0.4% of my portfolio

18:27 The 3Year Dividend CAGR is 19.3%

18:40 In general, I will not sell a huge winner. (Although, there was 1 exception, Apple.)

19:28 DIVIDEND STOCK 8: Bank of Hawaii (BOH) 0.3% of my portfolio

19:49 Regional banks are under a lot of pressure

20:00 Forward PE of 9

20:05 Dividend yield of 6.7%

21:11 If I had to sell something, maybe BOH would be on the list in the future.

22:35 DIVIDEND STOCK 9: Hasbro (HAS) 0.2% of my portfolio

22:49 Lackluster business performance the last few years

23:16 Forward PE of 14.53 with 4.33% dividend yield

24:04 If I had to make a deeper cut, I would probably sell HAS.

26:12 DISCLOSURE AND DISCLAIMER

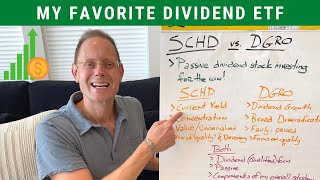

DISCLOSURE: I am long Caterpillar (CAT), Walmart (WMT), BP (BP), Shell (SHEL), Chevron (CVX), IBM (IBM), Utz Brands, Inc. (UTZ), Carrier (CARR), Raytheon Technologies (RTX), Otis (OTIS), Bank of Hawaii (BOH), Hasbro (HAS), Raytheon Technologies (RTX), PepsiCo (PEP), Starbucks (SBUX), and SCHD. I own these stocks in my personal dividend stock portfolio.

DISCLAIMER: All information and data on my YouTube Channel, blog, email newsletters, white papers, Excel files, and other materials is solely for informational purposes. I make no representations as to the accuracy, completeness, suitability or validity of any information. I will not be liable for any errors, omissions, losses, injuries or damages arising from its display or use. All information is provided AS IS with no warranties, and confers no rights. I will not be responsible for the accuracy of material that is linked on this site.

Because the information herein is based on my personal opinion and experience, it should not be considered professional financial investment advice or tax advice. The ideas and strategies that I provide should never be used without first assessing your own personal/financial situation, or without consulting a financial and/or tax professional. My thoughts and opinions may also change from time to time as I acquire more knowledge. These are, as discussed above, solely my thoughts and opinions. I reserve the right to delete any comments for any reason (abusive in nature, contain profanity, etc.). Your continued reading/use of my YouTube Channel, blog, email newsletters, whitepapers, Excel files, and other materials constitutes your agreement with and acceptance of this disclaimer.

COPYRIGHT: All PPC Ian videos, Excel files, guides, and other content are (c) Copyright IJL Productions LLC. PPC Ian is a registered trademark (tm) of IJL Productions LLC.