A Method To Help Families Minimize Taxes on IRAs

Get together with likeminded individuals in our Impactful Inheritance community to discuss planning, preservation, and protection of wealth. Join our community today and start making a difference for future generations. 30 day free trial at the following link: https://www.impactfulinheritance.com/...

To request a free zoom video meeting to design your estate plan, click the following link and complete the short questionnaire: https://aeplaw.cliogrow.com/intake/71...

0:00 How To Minimize Taxes on Traditional IRAs

0:20 Each Family Is Unique

0:48 It Is OK To Reduce Your Taxes Legally

1:21 How Much Income Tax on Traditional IRA

1:40 Why People Have Large IRAs

2:14 The Likely IRA Scenario

5:24 The Qualified Disclaimer Scenario

10:02 Summary of the Two IRA Strategies

12:31 You Have Three Options

12:47 Name Spouse as Primary and Children as Contingent Beneficiaries

14:31 Designate Children as Primary Beneficiaries

15:06 Designate Conduit Trusts as Beneficiaries

15:38 Why Few Will Take Advantage of This

17:06 What Will Happen If You Avoid This Video

17:44 What To Tell Your Family About Your IRA

18:30 Share This Video With Other IRA Owners

This video explains what you may not realize about IRA beneficiary designations and Inherited IRAs that could cause your family to send significantly more money to the IRS than they really need.

So what I’ve learned from 30 years of estate planning is that every family is unique and each family, each couple, and each individual needs to make their own decisions that are in their best interest and in the best interests of their loved ones. And hopefully this video will enable you to make betterinformed decisions so that you can keep and protect more of what you have for yourself and your family, while sending less to the almighty federal government.

After all, our own United States Supreme Court stated in the 1935 case of Gregory v. Helvering, stated that the right of a taxpayer to decrease the amount of what otherwise would be his taxes, or altogether avoid them, by means which the law permits, cannot be doubted. And to quote Judge Learned Hand, we may “arrange our affairs so that our taxes shall be as low as possible; we are not bound to choose that pattern which best pays the treasury. We do not even have a patriotic duty to raise our taxes."

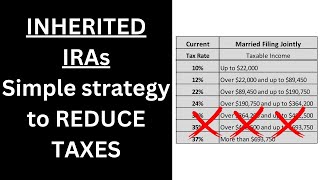

So this video has to do with how much income tax families will pay on an IRA owner’s traditional IRA. We are not talking about the nontaxable Roth IRAs. We are discussing those notyettaxed traditional IRAs. Many people have large IRAs because they accumulate significant amounts in their company 401(k), and then retire and roll their 401(k) account balance over into a traditional IRA. In fact there are many people out there who, while they were working, they were frugal, they maxed out their contributions to their 401(k), some or all of those contributions were matched by the employer, and they retired with a healthy six figure IRA, seven figure IRA (which means $1 million or more), and in some cases eight figure IRA.

For Louisiana residents only: For prospective law firm clients who want to schedule a free 30 minute initial phone call with an estate planning attorney at the Louisiana estate planning law firm of Rabalais Estate Planning, LLC, go to: https://go.oncehub.com/Paul8

This post is for informational purposes only and does not provide legal advice. Please do not act or refrain from acting based on anything you read on this site. Using this site or communicating with Rabalais Estate Planning, LLC, through this site does not form an attorney/client relationship.

Paul Rabalais

Estate Planning Attorney