Accounting for Pensions vs. Other Postretirement Benefits

This video compares and contrasts the accounting for pensions (specifically, accounting for defined benefit pension plans) and the accounting for other postretirement benefits like healthcare, life insurance, dental coverage, vision coverage, and group legal insurance.

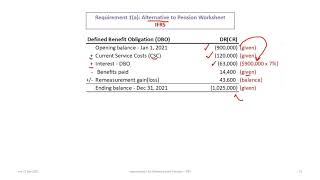

The accounting for pensions and other postretirement benefits is similar in that the company needs to make estimates about the amount of any future benefits and then discount those benefits to their present value to measure the company's obligation. The obligation is then netted with plan assets to present a single amount on the balance sheet; if the amount of the obligation exceeds the plan assets the net amount is a liability, and if the plan assets exceed the amount of the obligation the net amount is an asset. The periodic expense is then recorded on the income statement.

But there are a number of differences in the accounting for pensions versus the accounting for other postretirement benefits. For example:

Pension benefits are a set dollar amount and are thus easier to predict, whereas there is no upper limit for healthcare costs

Pension benefits increase with each year of service, whereas other postretirement benefits are granted on an allornothing basis

Pension beneficiaries include the retiree and maybe a spouse, whereas the beneficiaries of other postretirement benefits often include the retiree, spouse, and dependents (e.g., children)

These differences and more are discussed in the video.

0:00 Introduction

0:35 Similarities

1:17 Balance sheet

2:36 Income statement

2:54 Differences

7:58 Amortization of prior service costs

9:55 Amortization of net gain or net loss

—

Edspira is the creation of Michael McLaughlin, an awardwinning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a highquality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44PAGE GUIDE TO U.S. TAXATION

• A 75PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

* http://eepurl.com/dIaa5z

—

SUPPORT EDSPIRA ON PATREON

* / prof_mclaughlin

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSETLIABILITY MANAGEMENT

* https://edspira.thinkific.com

—

LISTEN TO THE SCHEME PODCAST

* Apple Podcasts: https://podcasts.apple.com/us/podcast...

* Spotify: https://open.spotify.com/show/4WaNTqV...

* Website: https://www.edspira.com/podcast2/

—

GET TAX TIPS ON TIKTOK

* / prof_mclaughlin

—

ACCESS INDEX OF VIDEOS

* https://www.edspira.com/index

—

CONNECT WITH EDSPIRA

* Facebook: / edspira

* Instagram: / edspiradotcom

* LinkedIn: / edspira

—

CONNECT WITH MICHAEL

* Twitter: / prof_mclaughlin

* LinkedIn: / profmichaelmclaughlin

—

ABOUT EDSPIRA AND ITS CREATOR

* https://www.edspira.com/about/

* https://michaelmclaughlin.com