Beneficiary IRAs: What to Know

What is the difference between a Spouse Beneficiary and a NonSpouse Beneficiary? What should you expect if you inherited an IRA after 2020? What factors should you consider when deciding on a beneficiary prior to the Secure Act 2.0?

In this video, John Bowens, Director, Head of Education and Investor Success at Equity Trust Company, explains the ins and outs of Beneficiary IRAs, also known as Inherited IRAs.

Can you SelfDirect your Beneficiary IRA/Inherited IRA? The answer is yes!

Download our guide to SelfDirected IRA Rules and Regulations: https://www.trustetc.com/lp/selfdire...

Timestamps

0:00 Intro

0:49 What is a Beneficiary IRA/Inherited IRA?

1:23 What are the three classifications of beneficiaries to retirement plans?

2:11 Spouse Beneficiary vs. NonSpouse Beneficiary

7:29 What is a NonDesignated Beneficiary?

8:20 What to know if you inherited an IRA prior to 2020

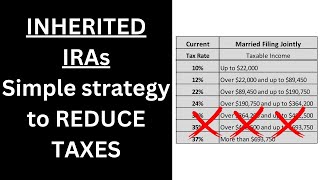

11:00 Inherited IRA rules after the Secure Act

13:28 What is an eligible designated beneficiary?

15:36 How are required minimum distributions dictated?

Equity Trust Company is a directed custodian and does not provide tax, legal, or investment advice. Any information communicated by Equity Trust Company is for educational purposes only and should not be construed as tax, legal, or investment advice. Whenever making an investment decision, please consult with your tax attorney or financial professional.