Bond Valuation | Introduction to Corporate Finance | CPA Exam BAR | Chp 7 p 1

IN this session, I explain bond valuation. Bond valuation is a way to determine the theoretical fair value (or par value) of a particular bond. Bond valuation is the determination of the fair price of a bond. Corporate bond valuation is the process of determining a corporate bond’s fair value based on the present value of the bond’s coupon payments and the repayment of the principal. Farhat Accounting Lectures can help you understand bond valuation, www.farhatlectures.com

✔Accounting students and CPA Exam candidates, check my website for additional resources: https://farhatlectures.com/

Connect with me on social media: https://linktr.ee/farhatlectures

#cpaexam #corporatefinance #accountingstudent

When a corporation or government wishes to borrow money from the public on a longterm basis, it usually does so by issuing or selling debt securities that are generically called bonds. In this section, we describe the various features of corporate bonds and some of the terminology associated with bonds. We then discuss the cash flows associated with a bond and how bonds can be valued using our discounted cash flow procedure.

BOND FEATURES AND PRICES

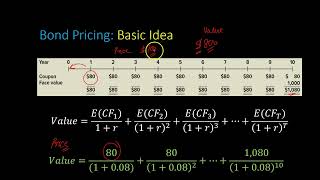

As we mentioned in our previous chapter, a bond is normally an interestonly loan, meaning that the borrower will pay the interest every period, but none of the principal will be repaid until the end of the loan. For example, suppose the Beck Corporation wants to borrow $1,000 for 30 years. The interest rate on similar debt issued by similar corporations is 12 percent. Beck will thus pay .12 × $1,000 = $120 in interest every year for 30 years. At the end of 30 years, Beck will repay the $1,000. As this example suggests, a bond is a fairly simple financing arrangement. There is, however, a rich jargon associated with bonds, so we will use this example to define some of the more important terms.

In our example, the $120 regular interest payments that Beck promises to make are called the bond’s coupons. Because the coupon is constant and paid every year, the type of bond we are describing is sometimes called a level coupon bond. The amount that will be repaid at the end of the loan is called the bond’s face value, or par value. As in our example, this par value is usually $1,000 for corporate bonds, and a bond that sells for its par value is called a par value bond. Government bonds frequently have much larger face, or par, values. Finally, the annual coupon divided by the face value is called the coupon rate on the bond; in this case, because $120/1,000 = 12%, the bond has a 12 percent coupon rate.

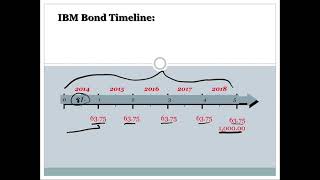

The number of years until the face value is paid is called the bond’s time to maturity. A corporate bond will frequently have a maturity of 30 years when it is originally issued, but this varies. Once the bond has been issued, the number of years to maturity declines as time goes by.

BOND VALUES AND YIELDS

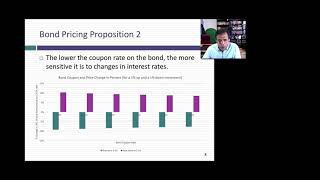

As time passes, interest rates change in the marketplace. The cash flows from a bond, however, stay the same. As a result, the value of the bond will fluctuate. When interest rates rise, the present value of the bond’s remaining cash flows declines, and the bond is worth less. When interest rates fall, the bond is worth more.

To determine the value of a bond at a particular point in time, we need to know the number of periods remaining until maturity, the face value, the coupon, and the market interest rate for bonds with similar features. This interest rate required in the market on a bond is called the bond’s yield to maturity (YTM). This rate is sometimes called the bond’s yield for short. Given all this information, we can calculate the present value of the cash flows as an estimate of the bond’s current market value.