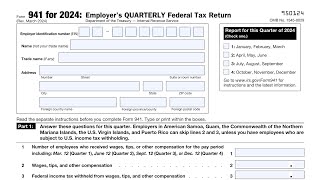

Breaking Down IRS Form 941: Employer’s Quarterly Federal Tax Return

Get an official IRS Form 941 here: https://eforms.com/irs/form941/

Employers are required to file quarterly tax returns for their employees using IRS Form 941. This form reports federal payroll taxes withheld from employees’ wages on a quarterly basis. Federal payroll taxes include income tax and the employer and employees’ FICA contributions to Social Security and Medicare.

In this video we’re going to break down:

Employers exempt from filing

Tax rates

Deadlines

How to file

And FAQs

DISCLAIMER:

This video is strictly for educational purposes and is in no way intended to provide legal advice. We do not make any warranties about the completeness, reliability, and accuracy of this information. Any action you take upon the information on this video is strictly at your own risk, and we will not be liable for any losses and damages in connection with the use of our videos.

#payrolltaxes #employeereporting #quarterlyfilings #941reporting #irsform941

____

0:00 Intro

0:44 What information is reported?

1:16 Tax Rates

2:04 Deadlines

2:54 How do you file Form 941?

3:14 What if I need to make a correction?

3:25 Do I need to file Form 941 Schedule B?

3:44 Are there penalties for not filing on time?

5:51 Conclusion