California Capital Gains Tax In 2024 Explained

In this video, we're going to talk about what capital gains taxes are and we'll dig into the basics of California capital gains taxes.

We’ll also show you different tax planning strategies that can significantly reduce your taxes:

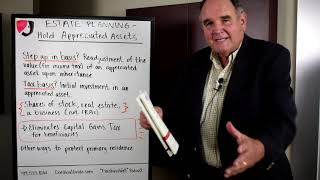

1.Set up a Charitable Remainder trust or CRUT to sell your asset tax free and receive a charitable income tax deduction of approximately 10% of the current value of the appreciated asset. As an example, if you have your assets in a lifetime CRUT, you can take home 80% or more after taxes compared to not using one and selling your assets in a regular taxable account over the course of your life: https://www.valur.io/learnposts/crt...

2.Use an opportunity zone fund to defer your capital gain tax and potentially avoid taxes on your opportunity zone investment. Investors who have realized capital gains can roll those gains into an opportunity zone fund: https://learn.valur.io/opportunityzo...

3. Diversify your investment using an exchange fund. An exchange fund allows investors to contribute stock. By aggregating the concentrated stock positions of many investors, an exchange fund allows you to substitute or replace your own concentrated stock position with a diversified basket of stocks of the same value, reducing portfolio risk and putting off tax consequences until later: https://learn.valur.io/exchangefunds/

00:00 Intro

01:01 What are capital gains?

02:35 Federal short vs. longterm capital gains

03:05 CA capital gains

03:33 Case study: AAPL stock

04:57 What is tax stragegy

05:18 Lifetime CRUTs

05:48 Opportunity Zone Fund

06:40 Exchange funds

CA capital gains tax indepth

https://learn.valur.com/californiaca...

Talk to us

https://www.valur.com/forms/schedule?...

![How to Calculate Taxable Gain from Selling a Rental [Tax Smart Daily 020]](https://i.ytimg.com/vi/VFqIr0GQKSk/mqdefault.jpg)