Complete Guide to ITR Filing for Crypto u0026 NFT Transactions | AY 2023-24 ft

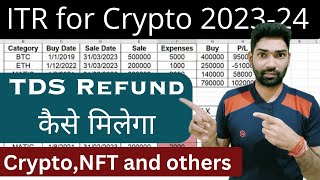

Welcome to our channel! In this video, we provide a comprehensive guide on how to file your Income Tax Return (ITR) for Crypto and NFT transactions for Assessment Year (AY) 202324. As the popularity of cryptocurrencies and nonfungible tokens (NFTs) continues to grow, it's crucial to understand the tax implications and properly report your transactions to stay compliant with the law.

In this video, we cover the following key points:

Overview of the taxation rules for cryptocurrencies and NFTs in AY 202324.

Understanding the different types of transactions and their tax treatment.

Reporting requirements for crypto and NFT income, including trading, mining, staking, and NFT sales.

Deductions and exemptions available for crypto and NFT activities.

Stepbystep instructions on filling out the relevant sections of your ITR form for crypto and NFT transactions.

Common mistakes to avoid when filing your ITR for crypto and NFT activities.

Resources and tools to assist you in accurately calculating your taxable income.

Filing your ITR for crypto and NFT transactions can be complex, but with the information provided in this video, you'll gain the knowledge and confidence to navigate the process effectively. Stay compliant and ensure your tax obligations are met.

Don't forget to like, share, and subscribe to our channel for more informative content on taxation and personal finance. Disclaimer: The information provided in this video is for educational purposes only and should not be considered as professional tax advice. Always consult with a qualified tax professional for personalized guidance regarding your specific tax situation.

Practical Courses

ITR, GST & TDS (Tax Combo) https://fintaxpro.in/Combo

Account Finalization https://fintaxpro.in/Accounting

ROC eFIling https://fintaxpro.in/courses/roc/

Trademark e Filing Course https://fintaxpro.in/TM

Taxation for Share Market https://fintaxpro.in/share

GST Course https://fintaxpro.in/GST

ITR & TDS Course https://fintaxpro.in/ITR

Excel Course https://fintaxpro.in/Excel

Taxation for Online Sellers https://fintaxpro.in/online

Balance Sheet & PnL Finalization https://fintaxpro.in/BstPnL

All in one Combo Course https://rzp.io/l/af2rF2p

Compliance Newsletter https://fintaxpro.in/newsletter/

For courses 7827521794

For services 9718097735

[email protected]

Telegram channel https://t.me/fintaxpro

FinTaxPro Mobile App http://bit.ly/3WJ63tX

FinTaxPro Social Handles https://linktr.ee/fintaxpro

FinTaxPro Studio Gear https://linktr.ee/fintaxpro_gear

Disclaimer Although all provisions, notifications, updates, and live demos are analyzed indepth by our team before presenting to the public. We hereby provide our point of view only and tax matters are always subject to frequent changes hence advisory is only for the benefit of the general public. Hence neither Fintaxpro Advisory LLP nor its designated partner is liable for any consequence that arises on the basis of YouTube videos.

Copyright Disclosure As per Sec 52 of The Copyright Act,1957 Fintaxpro Advisory LLP shared this video with a clear objective to educate the public at large and thus constitute the fair dealing with content for the purpose of reporting of current events and current affairs, including the reporting of a lecture delivered in public

©Fintaxpro Advisory LLP