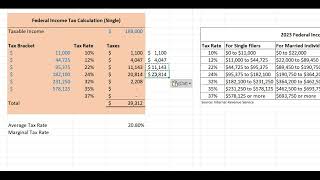

Effective Tax Rate vs Average Tax Rate

The average tax rate is calculated by dividing the total tax by taxable income:

average tax rate = total tax / taxable income

The effective tax rate, on the other hand, is calculated by dividing the total tax by TOTAL income, with total income including both taxable and nontaxable income:

effective tax rate = total tax / total income

The effective tax rate will be lower than the average tax rate when the taxpayer has taxexempt income (include that isn't subject to tax).

A third type of tax rate is the marginal tax rate, which is the rate that would be incurred on the next dollar of taxable income.

—

Edspira is the creation of Michael McLaughlin, an awardwinning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a highquality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44PAGE GUIDE TO U.S. TAXATION

• A 75PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

* http://eepurl.com/dIaa5z

—

SUPPORT EDSPIRA ON PATREON

* / prof_mclaughlin

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSETLIABILITY MANAGEMENT

* https://edspira.thinkific.com

—

LISTEN TO THE SCHEME PODCAST

* Apple Podcasts: https://podcasts.apple.com/us/podcast...

* Spotify: https://open.spotify.com/show/4WaNTqV...

* Website: https://www.edspira.com/podcast2/

—

GET TAX TIPS ON TIKTOK

* / prof_mclaughlin

—

ACCESS INDEX OF VIDEOS

* https://www.edspira.com/index

—

CONNECT WITH EDSPIRA

* Facebook: / edspira

* Instagram: / edspiradotcom

* LinkedIn: / edspira

—

CONNECT WITH MICHAEL

* Twitter: / prof_mclaughlin

* LinkedIn: / profmichaelmclaughlin

—

ABOUT EDSPIRA AND ITS CREATOR

* https://www.edspira.com/about/

* https://michaelmclaughlin.com