Elliott Wave Targets for Su0026P500 MELT-UP! | Elliott Wave Su0026P500 VIX Technical Analysis

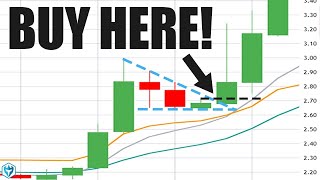

In this week's US market update, Rob Roy's Elliott Wave analysis for Stock, Crypto and Options Traders covers recent economic news, particularly the CPI and PPI reports, and how these may play into a meltup scenario. He further looks at Elliott Wave targets for the market. The CPI report came out weaker than expected, which initially led to a market decline on Thursday. Conversely, the PPI report was slightly hotter than expected, causing the markets to rise on Friday.

:: How to Subscribe to TRADEFINDER LIVE! for Free ::

Become a FREE Tradefinder Member using the link below.

As a subscriber you’ll watch live as Rob finds new trading opportunities each week.

► Registration Link: https://ewotrader.com/tradefinder/

:: Subscribe to the HUBB Channel for Live Updates and Q&A ::

To participate in Q&A with Rob Roy, join us at the HUBB YouTube channel. Click the link below now to subscribe for free.

► Registration Link: / @hubb_financial

:: Sections in this Video ::

00:00 Introduction

00:40 Economic News

01:25 SPY

04:53 TNX

06:25 US Dollar

07:45 DIA (Dow Jones)

09:23 QQQ

11:51 VIX

12:57 BTC

14:53 ETH

15:05 SLV

15:51 GLD

16:43 USO

18:35 TSLA

21:05 NVDA

22:09 UNG

23:43 INDA

24:53 FXI

:: To receive TRADE ALERTS for our strategies see links below ::

► EWO Volatility Strategy https://ewotrader.com/thevolatility...

► EWO Impulse Strategy https://ewotrader.com/theimpulsestr...

► EWO Time Strategy https://ewotrader.com/thetimestrategy/

:: Other Links to Follow Us::

► Instagram: / elliottwaveoptions

► Facebook: / elliottwaveoptions

► LinkedIn: / elliottwaveoptions

► Twitter: / ewotrader

► Website: http://www.ewotrader.com

Rob then examines the SPY (S&P 500), noting that despite the CPI report being negative, the market opened higher but reversed and closed lower. The PPI report's impact led to a recovery in the market, highlighting the unusual market behavior. He emphasizes that the markets are currently cautious, with a potential meltup scenario into the election and a subsequent correction if the Fed starts cutting rates.

The analysis moves to the TNX (10year Treasury yield), where Rob discusses the impact of lower interest rates on the economy and market sentiment. He suggests that a weakening economy could delay the Fed's rate cuts. He also touches on the dollar, noting its decline and the potential global concerns about US debt if the dollar weakens too much.

Rob proceeds to analyze the DIA (Dow Jones Industrial Average), mentioning the recent zigzag pattern and its implications. He also looks at the QQQ (NASDAQ100), noting that despite a pullback, it remains above the 10day moving average, and the market shows a broadening rally, especially evident in the IWM (Russell 2000), which broke out of a trading range.

He examines the VIX (Volatility Index), indicating its current low level around 12.5 and the potential for a drift lower, which could support a market meltup. Rob also discusses Bitcoin, noting its recent price movements and the factors influencing its volatility, such as government actions and supply changes.

The analysis extends to metals, specifically SLV (Silver ETF) and GLD (Gold ETF). Rob highlights the breakout patterns in both, with GLD showing a strong symmetrical triangle breakout. He mentions oil (USO), discussing its recent price movements and potential future scenarios.

In the stocks of interest section, Rob covers Tesla (TSLA), noting its recent volatility due to news about the delay of the robotaxi rollout. He also analyzes Nvidia (NVDA), suggesting a more moderated upward movement. Natural gas (UNG) is discussed, with Rob pointing out the need for it to break above certain moving averages to signal a bullish trend.

Lastly, he examines the Indian market (INDA) and the Chinese market (FXI), noting their recent movements and potential future directions. Rob concludes by inviting viewers to join the Trade Finder live webinars for more indepth market analysis and trading opportunities.