Filing a tax return on behalf of a deceased person

Subscribe to our YouTube channel: / @teachmepersonalfinance2169

This video walks you through situations you may encounter while handling taxes on behalf of a deceased person. This includes:

What to do if you're a surviving spouse

How to file the current year tax return

How to learn about the decedent's tax history

How to obtain a tax refund on behalf of the decedent, if applicable

You can go directly to the following IRS pages for more information:

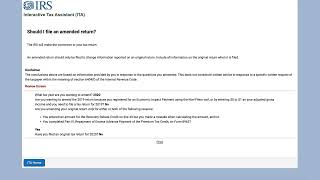

File the final tax returns of a deceased person: https://www.irs.gov/individuals/file...

Request deceased person's tax information:

https://www.irs.gov/individuals/reque...

If you’re looking for tutorials for other IRS Forms that you can file directly through the IRS website, check out our free fillable forms page: https://www.teachmepersonalfinance.co...

Here are links to articles we've written about other tax forms mentioned in this video:

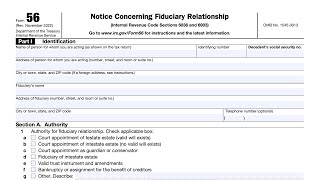

IRS Form 56, Notice Concerning Fiduciary Relationship

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 56 Walkthrough (Notice of Fi...

IRS Form 4506, Request for Copy of Tax Return

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 4506 walkthrough ARCHIVED CO...

IRS Form 4506T, Request for Transcript of Tax Return

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 4506T walkthrough (Request ...

IRS Form 8822, Change of Address

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 8822 walkthrough ARCHIVED ...

IRS Form 2848, Power of Attorney and Declaration of Representative

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 2848 walkthrough ARCHIVED ...

IRS Form 1310, Statement of a Person Claiming Refund Due a Deceased Taxpayer

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 1310 walkthrough ARCHIVED ...