How capital gains taxation changes will impact the farm succession plan

There may be a flurry of activity in several accountants' offices over the next 10 weeks as farm families grapple with how changes to the capital gains inclusion rate and exemption laid out in the latest federal budget may impact their succession planning.

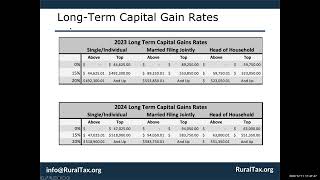

The government plans to increase the taxable portion of capital gains — the difference between the purchase and the sale price of property or an investment — in a given year from onehalf to twothirds. For individuals, the higher rate would only apply to capital gains above $250 thousand, with the old onehalf rate still applying to the first $250 thousand in gains. The higher twothirds rate would be applied to all capital gains realized by corporations and trusts.

At the same time, the lifetime capital gains exemption, which currently allows a Canadian to exempt just over a million dollars in capital gains taxfree on the sale of small business shares and farming and fishing property in their lifetime, will be increased to $1.25 million, and will continue to be indexed to inflation thereafter.

Ryan Kehrig, national leader of agriculture tax for MNP, says there are several angles to how these changes will shape financial decisions.

In many cases, the changes won't affect farms on an annual basis, but their impact will be felt when a farm is looking to sell or divest its main assets, including farmland and quota.

The government has listed June 25, 2024 as the date these changes take effect, which means anyone in the middle of farm succession needs to take careful note of how these changes may impact the numbers, and if accelerating the process to realize gains prior to the June deadline makes sense.

On one hand, the increased capital gains exemption for individuals might provide some options for those selling land, for example.

The bigger issue, however, is how this will impact the succeeding generation's ability to buyout their parents now that there could be a larger capital gains tax bill to be paid to government. If the older generation is expecting to set aside a specific amount for retirement, the tax burden will likely be passed on to the younger generation.

Website: https://www.realagriculture.com/

#farming #farmbusiness

Find us on our other social media platforms:

X/Twitter: / realagriculture

Instagram: / realagriculture

Facebook: / realagmedia

![Budget 2024: Capital Gains Tax is Increasing [Canada]](https://i.ytimg.com/vi/QyCQGuXdmcs/mqdefault.jpg)