How does CPP OAS and GIS WORK? Canada Government Pensions EXPLAINED!

Welcome to our informative video where we break down the complexities of the Canadian Pension Plan (CPP), Old Age Security (OAS), and Guaranteed Income Supplement (GIS). Whether you're contributing to these plans or planning for retirement, understanding the nuances is crucial.

In this video, we explore how CPP integrates with OAS and GIS, shedding light on common misconceptions. Many Canadians are unaware of the intricacies associated with these government pension plans, and it's essential to be wellinformed.

With over 24 years of experience, I provide licensed and trusted investment guidance for retirement, estate planning, investing, and other financial needs. Feel free to reach out for personalized advice; contact details are in the description.

The CPP is a governmentmanaged savings plan funded through paycheck deductions. Learn about the calculations, contribution considerations, and how the CPP amount is influenced by your contributions and years of maximum contributions.

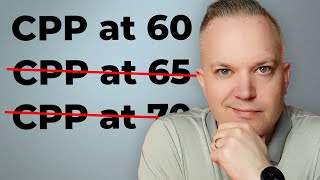

Discover the flexibility of starting CPP between 60 and 70, with insights on early vs. late benefits. Explore additional benefits, such as postretirement benefits and survivor pensions, for a comprehensive understanding of the CPP framework.

Moving on, we delve into the OAS, emphasizing its role as a significant government benefit. Understand the calculations, income thresholds, clawbacks, and the impact of duration spent in Canada on OAS benefits.

Explore the link in the description for more detailed information on OAS calculations and benefits, and grasp the importance of strategic financial planning to navigate potential clawbacks.

Lastly, we explore GIS, an additional income source for lowerincome individuals or couples. Learn about the application process, potential allowances, and how these government benefits are adjusted for inflation.

Government benefits are part of the retirement planning puzzle. Make informed decisions based on your unique circumstances, and consider consulting with an Investment Advisor Portfolio Manager for personalized guidance.

Don't forget to check out the link in the description for the CPP calculator and additional resources. If you're approaching retirement, understanding these government benefit programs is crucial for securing your financial wellbeing.

Did you know that working with an Investment Advisor Portfolio Manager can significantly impact your retirement? Learn about the amazing differences between advisors and ensure a secure financial future. Click here to find out more!

See you soon, and may your retirement be as prosperous as your knowledge!

Connect with Joe Macek:

For personalized investment guidance or inquiries, reach out to Joe directly. Contact details are provided HERE!

https://joemacek.com/contactus/

Studies Showing Advisor Value!

https://advisors.vanguard.com/content...

https://www.pmresearch.com/content/i...

Links to Website Calculators

https://joemacek.com/resources/

https://financialcalculators.net/iapr...

#CPP #OAS #GIS #GovernmentPensions #RetirementPlanning #FinancialWellBeing #CanadianFinance #InvestmentAdvisor #PersonalFinance #FinancialEducation #RetirementIncome #IncomeSecurity #CanadianBenefits #CPPCalculator #TaxPlanning #InflationAdjustment #FinancialAdvisor #RetirementStrategy #WealthManagement