How Principal u0026 Interest Are Applied In Loan Payments | Explained With Example

FREE COURSE: Easily do this analysis on your phone. Learn to ‘Know Your Numbers!’ here: https://learn.realestatefinanceacadem...

FREE DOWNLOAD: Calculate how different payments impact your loan payoff: https://docs.google.com/spreadsheets/...

For Real Estate COURSES & COACHING, visit https://www.realestatefinanceacademy....

For COMMERCIAL LOANS, visit https://evergreen.llc

This video explains how principal and interest is applied on a loan as payments are made over time.

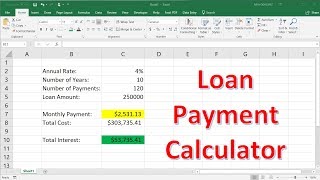

Amortization tables, and now of course, calculators and computers, give us the exact amount of how much a payment needs to be to cover the interest and to pay the loan off at a steady rate so that the loan is fully paid off to zero on the very last payment.

Each payment contains both principal and the interest that has accrued over that period.

Let's take a look at an example. Let's say we have a $100,000 loan at 6%, amortized over 30 years, our payment amount is going to be $599.55 each month.

$599.55 is our payment amount all the way through the life of the loan. Contained within that $599 is both the interest that accrued that month, and also the amount if the principal it's going to take to pay down the loan at the steady rate that we've determined.

Let's take a look at how that payment is broken down with each payment.

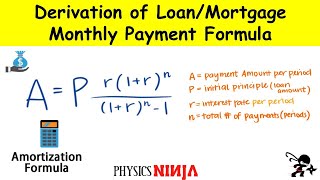

With the first payment, when our balance on the loan is $100,000, six percent interest per year equals half a percent per month. So each month we are paying one half percent interest on the current balance. So on the very first payment, that half percent interest is $500, which means that the remainder of the payment, $99.55 goes toward principal.

Since $99.55 was paid toward the principal, then when the second payment is due, the new balance on the loan is $99,900.45. So with the second payment, one half percent, or 6% annually, one half percent per month is due on the new balance. $99,900.45, which means that half a percent of that would be $499.50.

As we can see, the amount of interest with each payment that's being charged on loan is going down and since the remainder of the payment is applied to principal, then on the second payment, $100.05 is applied to principal, thereby reducing the unpaid principal balance again, so that on the third payment, our new balance is $998.40.

Half a percent on $99,800.40 is $499.00, which means that $100.54 will be paid towards principal, and so on and so forth.

On our last payment, or 360th payment, our balance is $596.57. Of that, $2.98 is interest, and then $596.57 is our final principle payment that pays the loan down to zero.

#investing #personalfinance #TrevorCalton #finance #principalandinterest #pandi #realestateinvesting #realestatetraining #realestatementoring #realestatefinance #EvergreenLLC #stepbystep #stepbysteptutorial #diagram #example #download #freedownload #howto

CRE loan

investing in real estate

investment properties and commercial real estate

commercial real estate lending

commercial real estate loan

SBA commercial real estate loan

commercial real estate financing

commercial property loan

commercial building loan

real estate lending

best commercial real estate loans

commercial property lending