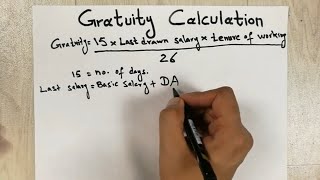

How to Calculate Gratuity of Government Employees | Pension Formula |

Anyone interested to learn Pakistan taxation including EFiling of both sale tax and income tax please WhatsApp or call at 03007574731.

Click on below WhatsApp link for further details of Practical Taxation Course

https://wa.me/923007574731?text=Pract...

Income tax Includes

1. Section149 Income from Salary

2. Section155 Income from Property

3. Section153 Payment of goods, service and contract

4. Section147 Advance income tax

5. Section148 Import

6. Section231AA and 236P Advance tax on certain banking transection

7. Section231B Advance tax at the time of registration of private motor vehicle

8. Section235A Tax collection from domestic electric bills

9. Section236 Tax collection from telephone users

10. Section236B Advance tax on purchase of domestic air ticket

11. Section236F Advance tax on cable operator and other electronic media

12. Section236G Advance tax on sale to distributor, dealer and wholesalers

13. Section236H Advance tax on sale to retailers

14. Section236I Advance tax by educational institutions

15. Section236U Advance tax on insurance premium

16. Section236X Advance tax on Tobacco

17. Section236Y Advance tax on remittance abroad through credit, debit or prepaid cards

18. Fine and penalties

19. Section177 Audit

20. Treatment of provision for bad and doubtful debts

Sale Tax Includes

1. What is sale tax or indirect tax and concept of VAT

2. Difference between Input and Output tax

3. Further tax and extra tax

4. Calculation of Sale tax

5. Advance sale tax

6. Withholding Sale tax

7. Debit and credit notes

8. Admissible credit

9. Annexure A, B, C, F,H, J and I with practical example

10. Supply and purchase register

11. Stock or consumption sheet

12. Concept of Punjab Revenue Authority (PRA) and Sindh Revenue Authority (SRB)

EFiling

1. Monthly sale tax return

2. Withholding Statement

3. Reconciliation of sale tax return

4. Reconciliation of wealth

5. Annual income tax return of Salary Individual

6. Annual income tax return of Company

7. Annual income tax return of Business Individual / Retailer or Trader

8. Annual income tax return of AOP

All above section will be cover with practical example and online filing.

Regards,

Faheem Mehboob

ACCA Member

03007574731