How to Calculate Internal Rate of Return “IRR”

Learn REAL ESTATE FINANCE & INVESTMENTS at https://realestatefinanceacademy.com/

For COMMERCIAL LOANS, visit https://www.evergreen.llc

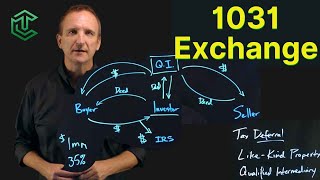

[00:00:50] Definition of IRR

[00:01:27] Example #1

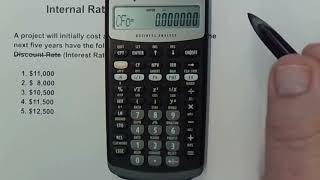

[00:01:50] Calculating IRR with a Financial Calculator

[00:03:14] Calculating IRR with a Spreadsheet

[00:03:40] Example #2

[00:05:10] How IRR and NPV Are Related

This video will explain when we are solving for "i" in our financial calculator, we are solving for internal rate return. IRR is also sometimes known as Effective Annual Rate or Effective Annual Yield depending on which side of the investment you're on.

Definition of IRR

Internal Rate of Return is the discount rate at which the net present value equals zero. It's effectively the regression line for all of the cash flows, including the initial cash flow and the final cash flows and accounts for the time value of money.

When you're solving for I, you're typically solving for the rate of return, which is your IRR.

Calculating IRR with a Spreadsheet

In Excel, we would just hit equals IRR and then highlight the array.

You'll notice that in Excel it asks you to guess. And I have mixed feelings about that. That's a different discussion, but that just reinforces my point of knowing how to calculate this on your calculator and do it right every time.

How IRR and NPV Are Related

What the NPV tells us is that if our target threshold for a return on investment is 8%, then any positive net present value exceeds 8%.

Internal Rate of Return is the discount rate, or the yield, at which the net present value equals zero.

Net Present Value tells you whether or not you have achieved the threshold that you set, But most of the time a finance manager or an investor is going to say, "Hey, I'm not going to do this investment unless I make at least 8%.

If you want to know the exact IRR of the cash flow, you'd be solving for (i) and that's your Internal Rate of Return.

I hope you enjoyed this lesson. Please don't forget to like and subscribe and all that. Thanks for watching.

#commercialrealestatecoaching #commercialrealestateinvesting #TrevorCalton #EvergreenLLC #financing #loans #lending #realestateinvesting #realestate #realestatefinance #investing #commercialrealestatetraining #commercialloan #commercialloans #apartmentloan #multifamilyloan #apartmentinvesting #multifamilyinvesting #realestateproforma #proforma #stepbystep #stepbysteptutorial #diagram #example #download #freedownload #howto

How to calculate internal rate of return for real estate investments

Maximizing returns through internal rate of return analysis

Understanding internal rate of return: A beginner's guide

Using internal rate of return to make better investment decisions

Internal rate of return vs. net present value: Which is better?

Why internal rate of return is important for evaluating investments

Realworld examples of internal rate of return in action

How to interpret internal rate of return results

The pros and cons of relying on internal rate of return for investment decisions

Internal rate of return and the time value of money explained

Internal Rate of Return

IRR

Investment analysis

Financial modeling

Capital budgeting

Discounted cash flows

Net present value

Time value of money

Return on investment

Cash flow analysis

Financial metrics

Financial management

Financial planning

Financial decisionmaking

Investment performance

Investment metrics

Investment evaluation

Business finance

real estate mentor

real estate investor training

mortgage broker training

commercial lender training

CRE loans

investing in real estate

investment properties and commercial real estate

commercial real estate lending

commercial real estate loan

SBA commercial real estate loan

commercial real estate financing

commercial mortgage broker

commercial lender

commercial property loan

commercial building loan

best commercial real estate loans

commercial property lending

mentorship

career development

![IRR vs. NPV Which To Use in Real Estate [& Why]](https://i.ytimg.com/vi/hGw2J__2adU/mqdefault.jpg)

![The Equity Multiple Explained For Real Estate Investors [What You Need To Know]](https://i.ytimg.com/vi/mA_VHzlpydE/mqdefault.jpg)