How to Get IRS Penalties Removed? - Fill Out Form 843 IRS Request For Penalty u0026 Interest Abatement

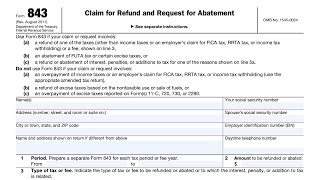

In this video, I answer the question about if (and when) the IRS will waive penalties and interest and I show you exactly how to request the IRS to remove penalties and/or interest using Form 843.

I cover two common situations:

1) if you elected Scorp status and didn't know you needed to pay yourself following employee payroll rules, so you are catching up your filings and you got an IRS letter with penalty and interest

2) If you fell behind on your Form 1040s and you get caughtup but also get an IRS letter with penalty and interest

Form843 Claim for Refund & Request for Abatement: https://www.irs.gov/formspubs/about...

Where do you mail the form? To the address on your letter with Interest & Penalties

Need help organizing or catching up your accounting and taxes? The free business spreadsheet template has a basic accounting worksheet, quarterly taxes and endofyear tax total worksheet.

Get it here: https://www.amandarussell.mba/gettheb...

Check out the SMALL BUSINESS SCHOOL here: https://www.amandarussell.mba/30dayac...

Other popular videos you may like:

The Balance Sheet Explained: • Balance Sheet Explained in Simple Ter...

What is a Holding Company? • What is a Holding Company? Holding ...

Does the LLC save taxes? • Tax Benefits of LLC vs. Sole Propriet...

Sole Proprietor vs. LLC vs. Scorp: • Sole Proprietor vs. LLC vs. Scorp: W...

How Businesses are Taxed: • How To Choose Your Business Structure...

9 Short Steps to Create Your LLC: • 9 Steps to Create Your LLC

![How to Get IRS Back Taxes Forgiveness 3 Different Ways [IRS Back Taxes Help] #backtax](https://i.ytimg.com/vi/IMHfw1-ePZs/mqdefault.jpg)

![4 Ways to Get Back Taxes Forgiveness [IRS Tax Relief] Settle for Less with the IRS](https://i.ytimg.com/vi/7tPXX7iK898/mqdefault.jpg)