How to pay for college Payment Plans VS 529 Plans VS Student Loans

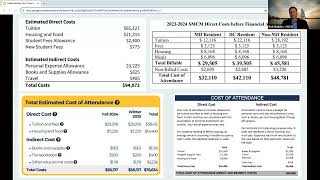

In this video, we discuss "What is the best way to pay for college Payment Plans VS 529 Plans VS Student Loans." In this video we discuss ideas and strategies to pay for the college tuition bill. The choices range from using a monthly payment plan or using the 529 college savings plans or going with a student loan. A 529 plan is a taxadvantaged savings plan designed to help pay for education. Originally limited to postsecondary education costs, it was expanded to cover K12 education in 2017 and apprenticeship programs in 2019. The two major types of 529 plans are savings plans and prepaid tuition plans. Savings plans grow taxdeferred, and withdrawals are taxfree if they're used for qualified education expenses. Prepaid tuition plans allow the account owner to pay in advance for tuition at designated colleges and universities, locking in the cost at today's rates. 529 plans are also referred to as qualified tuition programs and Section 529 plans.

Tuition payment plans spread out college fees into installments so you can pay over time (usually up to one year) instead of making one lump sum payment. They can also be a great alternative to borrowing loans. A tuition payment plan splits college bills into equal monthly or academic term payments. We discuss the Subsidized and Unsubsidized Federal Student loans from completing the Fafsa form. We also go into detail about the Parent Plus Loan. All to help you understand the process and help pay for the college cost. We discuss where to complete the paperwork on studentloans.gov and what forms you need to complete like the master promissory note and the Entrance Counseling paper work on studentloans.gov to get the $5,500 federal student direct Subsidized & Unsubsidized Federal Direct Student loans. Subsidized and unsubsidized loans are federal student loans for eligible students to help cover the cost of higher education at a fouryear college or university, community college, or trade, career, or technical school. A PLUS Loan is a student loan, which is part of the Federal Direct Student Loan Program, offered to parents of students enrolled at least half time, or graduate and professional students, at participating and eligible postsecondary institutions.The U.S. Department of Education offers eligible students at participating schools Direct Subsidized Loans and Direct Unsubsidized Loans. (Some people refer to these loans as Stafford Loans or Direct Stafford Loans.) To receive either type of loan, you must be enrolled at least halftime at a school that participates in the Direct Loan Program. Generally, you must also be enrolled in a program that leads to a degree or certificate awarded by the school. Direct Subsidized Loans are available only to undergraduate students who have financial need. Direct Unsubsidized Loans are available to both undergraduates and graduate or professional degree students. You are not required to show financial need to receive a Direct Unsubsidized Loan.

Useful Links

Student loan list:

https://www.salliemae.com/smartoption...

https://www.citizensbank.com/student...

https://www.discover.com/studentloans/

https://www.hesaa.org/oNJCLASS/jsp/NJ...

10 Ways to Show Demonstrated Interest to improve your College Admissions

• How to show Demonstrated Interest the...

Reasons to hire a College Advisor

• Reasons to hire a College Advisor to ...

Reasons Why You Shouldn't Hire a College Advisor

• Reasons Why You Shouldn't Hire a Coll...

Take Gap Year leap or head off to College?

• Take a Gap Year leap or head off to C...

If you need help with the college process please fee free to contact us at [email protected] or call at 9084001363.

#College #Financialaid #Loans