How to Record Sale of Publicly Traded Partnership (PTP) Units on Form 1040

Are you invested in Publicly Traded Partnership (PTP) investments? Be careful of the tax consequences...

PTPs are, by default, taxed as corporations unless they meet one of the gross income exceptions under the IRC. If the PTP qualifies, it retains its tax classification as a partnership rather than a corporation.

PTP investments issue the owner a Schedule K1 each year, as the PTP itself is not subject to tax, but the owners are subject to taxes on their investment.

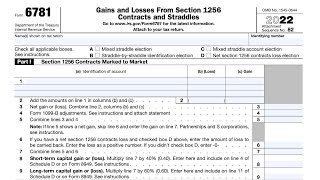

If a PTP investment is sold during the tax year, there are significant adjustments to the amounts of capital gain/loss and ordinary gain/loss on the tax returns. Failure to accurately make these adjustments will result in significant variances in a taxpayer's reported taxable income.

Form 8582 for PTP: • IRS Form 8582 (Passive Activity Loss)...

For a larger database of tutorials, please visit our website and search for your question:

https://knottlearning.com/

DISCLAIMER: The information provided in this video may contain information about tax, financial, and legal topics. Such materials are for informational purposes only and may not reflect the most current developments. These informational materials are not intended and should not be taken as tax, financial, or legal advice. You should contact an advisor to discuss your specific facts and circumstances. Selfhelp services may not be permitted in all states or jurisdictions. The use of these materials does not create an attorneyclient or confidential relationship. This video does not include information about every topic or issue related to these informational materials.

#PubliclyTradedPartnership #PTP #ScheduleK1

![How to Calculate Taxable Gain from Selling a Rental [Tax Smart Daily 020]](https://i.ytimg.com/vi/VFqIr0GQKSk/mqdefault.jpg)