I SOLD 14 Dividend Stocks This Week!

This week, I sold 14 stocks from my dividend stock portfolio. These stocks comprised 15% of my portfolio's value and 12% of my dividend income. Learn about my big moves, my criteria for selling stocks, and the three most shocking positions sold.

#dividend #stock #investing

Timestamps:

0:00 INTRODUCTION

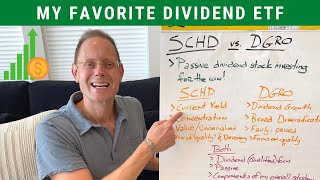

0:23 I now own 36 dividend stocks, however I'll probably own 37 soon, as I plan to build SCHD in a big way over the coming years.

2:30 SEGMENT 1: THOUGHTS ON SELLING DIVIDEND STOCKS

2:44 Insight: Selling is an opportunity to tighten up a portfolio, improving structure.

3:47 Insight: Reducing portfolio size can help motivate one to hustle and rebuild the portfolio!

4:51 What I'm Doing: Reinvestment is off, dividends are being used for living expenses, rebuilding cash reserves, and rebuilding my 15% (this time in SCHD).

5:58 Insight: Dividends are meant to be used (and even the underlying equity in some rare instances).

6:21 Thought Exercise For Home

6:40 Check out my Patreon (pinned comment below).

7:20 SEGMENT 2: MY 7 CRITERIA FOR SELLING DIVIDEND STOCKS

7:59 Criteria 1: No dividend yield (surprisingly, I had two stocks that paid no dividend)

8:27 When it comes time to pair down a portfolio (and live off dividends), the collection stocks just don’t make sense anymore.

8:51 Criteria 2: Overvalued dividend stocks (combined with low dividend yield)

9:35 Criteria 3: Loweryield dividend stocks (with fast dividend growth)

10:10 I need current yield now, and I can't wait as much for the future dividend growth.

10:33 Criteria 4: Long tail of ancillary positions that add unneeded complexity

11:16 What was fun during the accumulation phase does not really work in the optimization phase. I don't need extra overhead and work.

12:00 I plan to add SCHD regularly over the coming years to build back my 15% that I sold.

12:21 Criteria 5: Loser stocks don't have as much room in a smaller portfolio. When I have to sell something, I cannot rationalize selling a winner over a loser. Hence, the loser goes, even if it seems like a value.

13:30 Criteria 6: Fundamental Changes (poor fundamentals, such as a payout ratio over 100%)

14:22 Criteria 7: Portfolio Overlap (making sure not to have too much concentration in any category)

15:02 I'm now underweight tech and industrials. And, I'm overweight sin stocks.

16:35 SEGMENT 3: THE THREE MOST SURPRISING DIVIDEND STOCKS I SOLD

16:49 Dividend Stock 1: Apple (AAPL) Overvalued with a low dividend yield (and a nice gain in equity)

17:44 Right now, I need immediate cash flow now, as I'm going to use most of it right away.

18:40 Dividend Stock 2: 3M (MMM) I lost a lot of money on this, and just had to cut the loser. It was a complex decision to sell.

21:23 Dividend Stock 3: Colgate (CL) I sold this stock to keep my CPG weighting to a reasonable level.

23:20 DISCLOSURE AND DISCLAIMER

DISCLOSURE: I am long Procter & Gamble (PG) and Unilever (UL). I own these stocks in my personal dividend stock portfolio. I plan to buy SCHD.

DISCLAIMER: All information and data on my YouTube Channel, blog, email newsletters, white papers, Excel files, and other materials is solely for informational purposes. I make no representations as to the accuracy, completeness, suitability or validity of any information. I will not be liable for any errors, omissions, losses, injuries or damages arising from its display or use. All information is provided AS IS with no warranties, and confers no rights. I will not be responsible for the accuracy of material that is linked on this site.

Because the information herein is based on my personal opinion and experience, it should not be considered professional financial investment advice or tax advice. The ideas and strategies that I provide should never be used without first assessing your own personal/financial situation, or without consulting a financial and/or tax professional. My thoughts and opinions may also change from time to time as I acquire more knowledge. These are, as discussed above, solely my thoughts and opinions. I reserve the right to delete any comments for any reason (abusive in nature, contain profanity, etc.). Your continued reading/use of my YouTube Channel, blog, email newsletters, whitepapers, Excel files, and other materials constitutes your agreement with and acceptance of this disclaimer.

COPYRIGHT: All PPC Ian videos, Excel files, guides, and other content are (c) Copyright IJL Productions LLC. PPC Ian is a registered trademark (tm) of IJL Productions LLC.