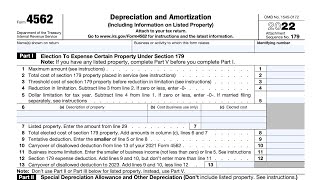

IRS Form 4562 (Depreciation u0026 Amortization) - Claim Section 179 Expense | Step-by-Step Guide

Form 4562 Bonus Depreciation: • IRS Form 4562 (Depreciation & Amortiz...

Form 4562 for Disallowed Section 179: • IRS Form 4562 (Depreciation) Disallow...

IRS Form 4562 reports regular depreciation & amortization, Section 179 expense, and special bonus depreciation.

For this example, we look at an S corporation's Form 4562, where the company claims Section 179 expense on two machinery purchases during the year. The Section 179 amount is separately stated on the K1s because it is subject to taxable income limitations for both the company and the individual shareholder.

For more information on depreciation for businesses, view the Form 4562 instructions and IRS Publication 946.

For a larger database of tutorials, please visit our website and search for your question:

https://knottlearning.com/

DISCLAIMER: The information provided in this video may contain information about tax, financial, and legal topics. Such materials are for informational purposes only and may not reflect the most current developments. These informational materials are not intended and should not be taken as tax, financial, or legal advice. You should contact an advisor to discuss your specific facts and circumstances. Selfhelp services may not be permitted in all states or jurisdictions. The use of these materials does not create an attorneyclient or confidential relationship. This video does not include information about every topic or issue related to these informational materials.

#Form4562 #BonusDepreciation #Section179