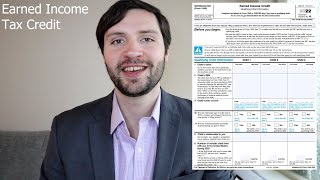

IRS Form 8814 walkthrough

Get access to customized perks with a membership today!

Join this channel to get access to perks:

/ @teachmepersonalfinance2169

Learn more about reporting your child's interest and dividends on your tax return using IRS Form 8814 in our article: https://www.teachmepersonalfinance.co...

Purpose of Form

Use this form if you elect to report your child’s income on your return.

If you do, your child will not have to file a return. You can make this

election if your child meets all of the following conditions.

• The child was under age 19 (or under age 24 if a fulltime student)

at the end of 2022. "Student" is defined below.

• The child’s only income was from interest and dividends,

including capital gain distributions and Alaska Permanent Fund

dividends.

• The child’s gross income for 2022 was less than $11,500.

• The child is required to file a 2022 return.

• The child does not file a joint return for 2022.

• There were no estimated tax payments for the child for 2022

(including any overpayment of tax from his or her 2021 return

applied to 2022 estimated tax).

• There was no federal income tax withheld from the child’s

income.

You must also qualify. See Parents who qualify to make the

election below.

Note. The amounts at $1,150 and below are not taxed when using

this election. See Rate may be higher for more information.

![Power Automate Beginner to Pro Tutorial [Full Course]](https://i.ytimg.com/vi/1p5kI7SYz4Q/mqdefault.jpg)