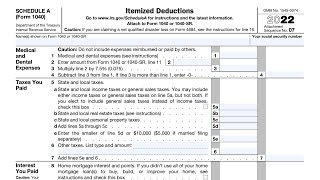

IRS Schedule A (Itemized Deductions) - Deducting Real Property Taxes

Form 1040 Schedule A is completed to report itemized deductions for U.S. taxpayers. Homeowners are generally entitled to a tax deduction for real property taxes paid on their homes. The deductible amount, however, is limited to the Ad Valorem component of the property tax bill. Deductions are not allowed for NonAd Valorem assessments.

In this example, we look at a taxpayer that paid his property tax bill which includes the Ad Valorem and NonAd Valorem components. The taxpayer separates the two amounts and does not deduct the NonAd Valorem taxes on his Schedule A.

For a larger database of tutorials, please visit our website and search for your question:

https://knottlearning.com/

DISCLAIMER: The information provided in this video may contain information about tax, financial, and legal topics. Such materials are for informational purposes only and may not reflect the most current developments. These informational materials are not intended and should not be taken as tax, financial, or legal advice. You should contact an advisor to discuss your specific facts and circumstances. Selfhelp services may not be permitted in all states or jurisdictions. The use of these materials does not create an attorneyclient or confidential relationship. This video does not include information about every topic or issue related to these informational materials.

#ScheduleA #Form1040 #PropertyTaxes