Payroll Accounting: Calculating federal tax withholdings percentage method

Mandatory paycheck deductions include Federal Income tax for all employees. This is an employeeonly tax, which means that the employer does not contribute a matching amount like employers do for FICA tax. The starting point for calculating the federal withholdings is the Form W4 which is completed by the employee on paper or online. The employer acts as the collector and depositor for these federal income tax withheld from the employees' paychecks and is responsible for the accuracy of the federal tax withholdings.

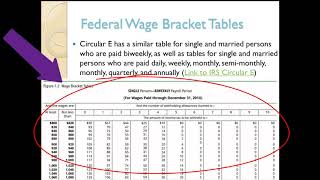

This video covers the detailed steps of how to calculate the federal tax withholdings using the percentage method. Payroll accountants typically rely on software programs to calculate federal tax withholdings but must be able to do so manually if the need arises or to test that systems work as expected. The detailed steps of calculating taxable wages and the federal tax withholdings using the percentage method are important for you to understand, and you will need to be able to apply this knowledge in your homework and the unit exams.

Ask yourself: Are all of the steps clear? In what area do you need more practice?

#accounting

#accountinglectures

#accountingtutorials

#accountingconcepts

#accounting_concept

#accountingtips

#accountingbasics

#payrollaccounting

#payroll

#cpa

#taxes

#cpatips