Private Company Valuation (2024 Level II CFA® Exam – Equity – Module 6)

Prep Packages for the CFA® Program offered by AnalystPrep (study notes, video lessons, question bank, mock exams, and much more):

Level I: https://analystprep.com/shop/cfaleve...

Level II: https://analystprep.com/shop/learnpr...

Levels I, II & III (Lifetime access): https://analystprep.com/shop/cfaunli...

Prep Packages for the FRM® Program:

FRM Part I & Part II (Lifetime access): https://analystprep.com/shop/unlimite...

Topic 5 – Equity

Module 6 – Private Company Valuation

LOS : Contrast important public and private company features for valuation purposes.

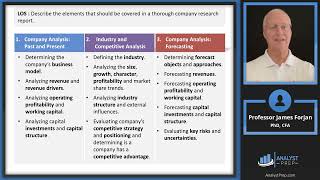

LOS : Describe uses of private business valuation and explain key areas of focus for financial analysts.

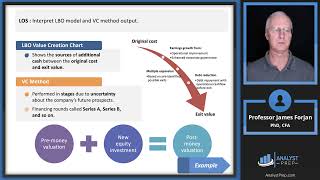

LOS : Explain cash flow estimation issues related to private companies and adjustments required to estimate normalized earnings.

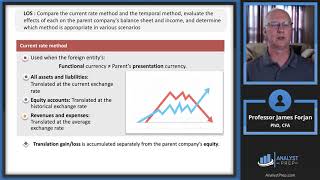

LOS : Explain factors that require adjustment when estimating the discount rate for private companies.

LOS : Compare models used to estimate the required rate of return to private company equity (for example, the CAPM, the expanded CAPM, and the buildup approach).

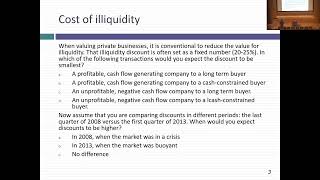

LOS : Explain and evaluate the effects on private company valuations of discounts and premiums based on control and marketability.

LOS : Explain the income, market, and assetbased approaches to private company valuation and factors relevant to the selection of each approach.

LOS : Calculate the value of a private company using incomebased methods.

LOS : Calculate the value of a private company using marketbased methods and describe the advantages and disadvantages of each method.