Session 11: Costs of Debt u0026 Capital

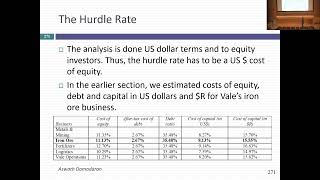

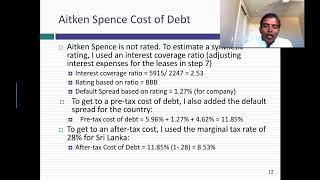

Intros class, we started by looking at estimating a cost of debt, specifying that it is the cost of borrowing money long term, today. Finally, w explained our preferences for market value weights on debt and equity in a cost of capital calculation, arguing that market value weights trump book value weights every single time. For the market value of debt, we argued for including both interest bearing debt converted to market value and the present value of lease commitments. To get a cost of debt, you need a bond rating (actual or synthetic) as well as default spreads that go with these ratings. The former should be available for your company, if it is rated. If not, use the following spreadsheet to rate your company:

http://www.stern.nyu.edu/~adamodar/pc...

It comes with a lease converter, if you want to use it. The default spreads used to be accessible online for free at bondsonline.com, but it seems to be defunct. You can get default spreads for key ratings classes (AAA, AA, A, BBB, BB, B and CCC & below) from the Federal Reserve website in St. Louis.

https://fred.stlouisfed.org/categorie...

Look for the effective yield and then subtract out the risk free rate from it. While you may have to extrapolate from these numbers for intermediate ratings, it is eminently doable. Alternatively, you can get updated spreads for every ratings class from a Bloomberg terminal by typing in FIW, and resetting a couple of inputs.

Slides: https://pages.stern.nyu.edu/~adamodar...

Post class test: https://pages.stern.nyu.edu/~adamodar...

Post class test solution: https://pages.stern.nyu.edu/~adamodar...