Session 2: First Steps on Valuation - Bias and the Bermuda Triangle

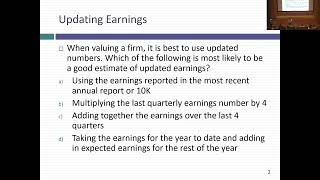

Today's class started with a test on whether you can detect the direction bias will take, based on who or why a valuation is done. The solutions are posted online on the webcast page for the class. We then moved on to talk about the three basic approaches to valuation: discounted cash flow valuation, where you estimate the intrinsic value of an asset, relative valuation, where you value an asset based on the pricing of similar assets and option pricing valuation, where you apply option pricing to value businesses. With discounted cash flow valuation, we started on the assessment phase by looking at its advantages (business understanding, cash flows to back you up) and disadvantages,. We will be starting on the first lecture note packet on Monday. So, please print off the packet or download it to your digital device and bring it to class.

Start of the class test: https://pages.stern.nyu.edu/~adamodar...

Slides: https://pages.stern.nyu.edu/~adamodar... & https://pages.stern.nyu.edu/~adamodar...

Post class test: https://pages.stern.nyu.edu/~adamodar...

Post class test: https://pages.stern.nyu.edu/~adamodar...