Session 20: Analyzing Multiples

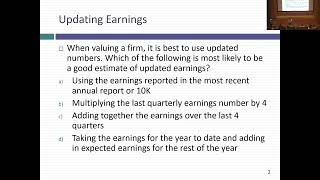

In this session, we continued with our discussion of pricing, starting with the analytics that drive PEG, PBV, EV/EBITDA and revenue multiples. During the session, I played the role of a naive equity research analyst, using sloppy pricing to push buy recommendations on stocks in a number of sectors, based purely on the level of multiples (low PE, low PBV etc.) and asking for pushback. I The bottom line, though, is that most companies that look cheap deserve to be cheap. The key to pricing is finding a mismatch between the pricing and the fundamentals (low PE & high growth, low PBB and high ROE, low EV to Sales and high margins). It is the basis for much of equity research, and takes the form of screens. If you are interested, I have a post that expands on the notion of screening.

http://aswathdamodaran.blogspot.com/2...

Start of the class test: https://pages.stern.nyu.edu/~adamodar...

Slides: https://pages.stern.nyu.edu/~adamodar...

Post class test: https://pages.stern.nyu.edu/~adamodar...

Post class test: https://pages.stern.nyu.edu/~adamodar...