Session 6: Betas and Beyond

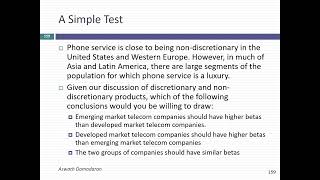

In this session, after a brief mopup on why it is dangerous to deviate too much from the implied ERP, we talked about betas. In particular, we noted that estimating a beta by running a regression against a market index can yield junk, and we talked about alternatives. Some of these alternatives are built around estimating risk using something other than prices, and some are built around looking at total risk. We did end the session with ttalk about bottom up betas, focusing on defining comparable firms and expanding the sample. I did make a big deal about bottom up betas, but may have still not convinced you or left you hazy about some of the details. If so, I thought it might be simpler to just send you a document that I put together on the top ten questions that you may have or get asked about bottom up betas. I think it covers pretty much all of the mechanics of the estimation process, but I am sure that I have missed a few things.

http://www.stern.nyu.edu/~adamodar/Ne...

Start of the class test: https://www.stern.nyu.edu/~adamodar/p...

Slides: https://www.stern.nyu.edu/~adamodar/p...

Post class test: https://www.stern.nyu.edu/~adamodar/p...

Post class test solution: https://www.stern.nyu.edu/~adamodar/p...