SHOULD I PUT IT ALL IN SCHD? (u0026 Sell My Individual Dividend Stocks)

Dividend investors love SCHD, Schwab U.S. Dividend Equity ETF. Should I sell my individual stocks and place all my capital in SCHD? Today's video shares my analysis of SCHD, and six unique characteristics I love about this ETF. While I won't be selling any stocks, I do see myself establishing a position in SCHD in the future.

#schd #dividend #etf

Timestamps:

0:00 INTRODUCTION: Dividend growth investors love SCHD. Should I sell my individual stocks and just own SCHD instead?

0:15 Charles Schwab SCHD performance has been 12.73% per year, on average (last 10 years).

0:57 Dow Jones U.S. Dividend 100 Index Underlying index has delivered 11.97% per year, on average. This is higher than the S&P 500 (total returns).

1:54 If I buy this ETF, I will use the dividends right away to pay bills (no reinvestment for me, as far as SCHD goes).

2:02 Without dividends reinvested, the Dow Jones U.S. Dividend 100 Index has driven 8.36% per year, on average.

2:57 SEGMENT 1: WHY I LIKE SCHD

2:58 REASON 1: SCHD OFFERS 100 QUALITY DIVIDEND STOCKS

3:43 This is a quality dividend ETF, based on performance.

3:59 They have 46 pages of dividend stock selection criteria.

4:35 Turnover is low.

4:51 REASON 2: BROAD DIVERSIFICATION INTO DIVIDEND STOCKS I DON’T HAVE

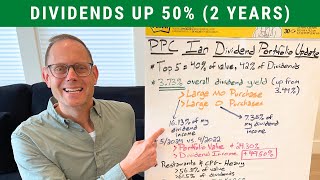

5:02 Top 26 Stocks In SCHD (I only own about 31% of them!)

6:16 I only own 31% of the stocks in SCHD, but I actually think the real number is lower (because of position weighting).

6:50 Diversification is more important than ever before.

7:07 REASON 3: I CAN USE SCHD TO PAY MY BILLS RIGHT NOW

7:23 I have a hard time using dividends from my core stocks to pay bills. (I reinvest.) With SCHD, I would not mind just pulling dividends for bills. It’s psychological.

8:16 REASON 4: I HATE SELLING STOCKS (SCHD does this for me, without me having to see!)

8:23 It was really painful selling NSC.

0:57 I don't like seeing stocks sold, but I don't have to see it with SCHD.

10:13 REASON 5: DAMPEN VOLATILITY IN MY PORTFOLIO

10:20 I bought Treasuries to provide cash flow while lowering portfoliowide volatility. I see the same effect with SCHD.

11:08 REASON 6: AUTOMATION OF INVESTING (Less daytoday management work for me.)

11:55 I'm not going to sell my stocks and redeploy into SCHD, but on a goforward basis, I see myself buying and adding to SCHD.

12:11 SEGMENT 2: SCHD FINANCIAL METRICS ANALYSIS

12:20 Only 12% off 52week high, which is amazing.

12:35 Low PE of 14.91.

12:46 Starting yield of 3.6% (based on TTM dividends). 3.96% based on forward anticipated yield.

13:08 They are growing the dividend by 13.7% per year, on average. This is HUGE. Although, I expect it to slow down.

13:21 Expense ratio is only 0.06%.

14:15 SEGMENT 3: $100,000 IN SCHD (HOW MUCH DIVIDEND INCOME?)

15:10 SEGMENT 4: QUALIFIED DIVIDENDS FROM SCHD

16:12 SEGMENT 5: SECTOR ALLOCATION FOR SCHD (AND MARKET CAP ALLOCATION)

17:37 DISCLOSURE AND DISCLAIMER

DISCLOSURE: I am long PepsiCo (PEP), CocaCola (KO), The Home Depot (HD), IBM (IBM), Pfizer (PFE), Altria (MO), 3M (MMM), and KimberlyClark (KMB). I’m also long Treasuries. I may initiate a position in SCHD.

DISCLAIMER: All information and data on my YouTube Channel, blog, email newsletters, white papers, Excel files, and other materials is solely for informational purposes. I make no representations as to the accuracy, completeness, suitability or validity of any information. I will not be liable for any errors, omissions, losses, injuries or damages arising from its display or use. All information is provided AS IS with no warranties, and confers no rights. I will not be responsible for the accuracy of material that is linked on this site.

Because the information herein is based on my personal opinion and experience, it should not be considered professional financial investment advice or tax advice. The ideas and strategies that I provide should never be used without first assessing your own personal/financial situation, or without consulting a financial and/or tax professional. My thoughts and opinions may also change from time to time as I acquire more knowledge. These are, as discussed above, solely my thoughts and opinions. I reserve the right to delete any comments for any reason (abusive in nature, contain profanity, etc.). Your continued reading/use of my YouTube Channel, blog, email newsletters, whitepapers, Excel files, and other materials constitutes your agreement with and acceptance of this disclaimer.

COPYRIGHT: All PPC Ian videos, Excel files, guides, and other content are (c) Copyright IJL Productions LLC. PPC Ian is a registered trademark (tm) of IJL Productions LLC.