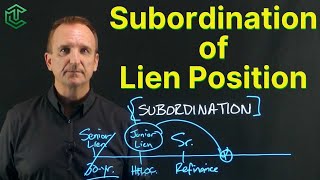

Subordination of Lien Position

LEARN REAL ESTATE FINANCE at https://realestatefinanceacademy.com/

For COMMERCIAL LOANS, visit https://www.evergreen.llc

Explaining Subordination of Lien Position

Subordination is when the claim of one creditor to a real estate asset is subordinated, or made junior to, the claim of another. This is pretty common, especially in the case of refinancing debt. So let's talk about it, and I'll show you how it works.

Imagine this is your timeline. And, here we have Year 0, or the day of acquisition. And on this date we have senior debt placed on the property. As we know, claims to any real estate are prioritized in chronological order as to when they were made against the property, and recorded on the title. So when we have senior debt on a property, if we go ahead and a little while later, we add some junior debt, the junior debt is subordinate to the senior debt, in that its claim on the title was made after the senior debt.

Then what happens if the senior debt refinances and a new loan is placed on after the junior debt? So imagine that this debt goes away, and now we have this debt. Well if this is the senior debt, or the primary loan on the property, if it was made chronologically after the junior debt, then technically it would not have priority over the junior debt, it would be subordinate.

So in this case, typically senior debt holders will require that the junior debt holders sign what's called a subordination agreement. And subordination agreements effectively say we as the junior debt holder agree to subordinate behind whoever is executing the subordination agreement. So effectively what would happen is, the junior debt holders claim would now be subordinated behind the senior debt.

So that in the event of foreclosure, the senior debt holder would be paid back first, and then if there are excess funds leftover, then that junior debt holder would get paid.

If you have questions, please share them in the comments below. We'll answer all questions AND your questions help us to build more helpful material!

CRE loan

investing in real estate

investment properties and commercial real estate

commercial real estate lending

commercial real estate loan

SBA commercial real estate loan

commercial real estate financing

commercial property loan

commercial building loan

real estate lending

best commercial real estate loans

commercial property lending

#commercialrealestatecoaching #commercialrealestateinvesting #TrevorCalton #investing #realestate #EvergreenLLC #realestateinvesting #commercialrealestate #realestatefinance #realestateloan #loans #lending #realtortraining #subordination #subordinate #stepbystep #stepbysteptutorial #diagram #example #download #freedownload #howto

CRE loan

investing in real estate

investment properties and commercial real estate

commercial real estate lending

commercial real estate loan

SBA commercial real estate loan

commercial real estate financing

commercial property loan

commercial building loan

real estate lending

best commercial real estate loans

commercial property lending

Other Queries :

real estate finance course

subordination meaning definition explanation

2nd lien subordination

mortgage subordination

lien subordination

lien subordination meaning definition explanation

refinancing your mortgage

real estate finance basics

explaining subordination of lien position

understanding subordination of lien position

subordination of lien position

real estate asset is subordinated

mortgage refinancing