Tax Basis vs. At-Risk Basis [CPA Prep]

Start your CPA Exam preparation with Examprep.ai: https://cpa.examprep.ai'>https://cpa.examprep.ai'>https://cpa.examprep.ai'>https://cpa.examprep.ai'>https://cpa.examprep.ai'>https://cpa.examprep.ai'>https://cpa.examprep.ai'>https://cpa.examprep.ai

Unlock a holistic learning experience tailored to help you pass the CPA exams. Gain access to interactive quizzes, practice exams, and taskbased simulations that mirror the real exam experience. Our AIdriven platform adapts to your learning style, providing personalized pathways to master each section of the CPA exam.

✨ Try it for FREE: https://cpa.examprep.ai'>https://cpa.examprep.ai'>https://cpa.examprep.ai'>https://cpa.examprep.ai'>https://cpa.examprep.ai'>https://cpa.examprep.ai'>https://cpa.examprep.ai'>https://cpa.examprep.ai ✨

Lesson Overview:

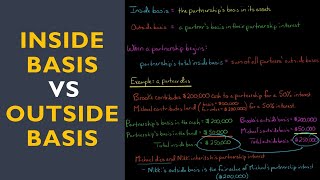

In this lesson, Nick Palazzolo, CPA, takes a deep dive into the intricacies of tax basis and atrisk basis, emphasizing their significance in partnerships, though also applicable to other investments. He elucidates the calculation of a partner's tax basis as the original purchase price adjusted for various factors like contributions, depreciation, and losses, which comes into play when determining the gain or loss upon disposal of that interest. Moving on, Nick clarifies the concept of atrisk basis, which is essential in limiting the amount of deductible losses based on the actual economic risk assumed by the taxpayer. Through an engaging walkthrough, he differentiates between recourse and nonrecourse loans and their effect on a taxpayer's atrisk basis, further illustrated by a practical example involving a partnership investment. This thorough explanation enables a fuller understanding of how these bases affect the recognition and limitation of losses, a critical component for grasping more complex partnership tax scenarios.

Key Topics Covered:

Tax Basis Calculation

AtRisk Basis

Partnership Taxation

Deductible Loss Limitations

Learn More and Elevate Your CPA Exam Preparation:

Our comprehensive course offers a unique blend of AIdriven personalized learning experiences, expert insights, and practical exercises designed to ensure you're fully prepared to conquer the CPA exams.

Begin your journey to becoming a Certified Public Accountant today!

Visit https://cpa.examprep.ai'>https://cpa.examprep.ai'>https://cpa.examprep.ai'>https://cpa.examprep.ai'>https://cpa.examprep.ai'>https://cpa.examprep.ai'>https://cpa.examprep.ai'>https://cpa.examprep.ai for a free trial no payment method required.

Join the Examprep.ai Community:

Website: https://cpa.examprep.ai'>https://cpa.examprep.ai'>https://cpa.examprep.ai'>https://cpa.examprep.ai'>https://cpa.examprep.ai'>https://cpa.examprep.ai'>https://cpa.examprep.ai'>https://cpa.examprep.ai

Facebook: / examprepai

Twitter: / examprepai

LinkedIn: / examprepai

#CPAExam #Accounting #ExamPrepAI

![PassThrough Loss Limitations [CPA Prep]](https://i.ytimg.com/vi/txLbQaDK0po/mqdefault.jpg)

![DAX Filter Context Basics [Full Course]](https://i.ytimg.com/vi/Rpa8mDH7mes/mqdefault.jpg)

![HandsOn Power BI Tutorial Beginner to Pro [Full Course] 2023 Edition⚡](https://i.ytimg.com/vi/77jIzgvCIYY/mqdefault.jpg)