Tax Form 1099-R Explained || Taxable Retirement Distributions or Not?

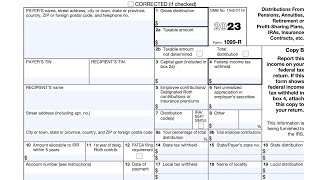

What is tax form 1099R and each of the boxes on the form. Boxbybox explanation of the information on form 1099R.

Timecodes:

00:00 Intro

00:15 When do you receive form 1099R?

03:19 When are you able to combine RMDs?

04:06 Gross distribution in Box 1 of tax form 1099R.

05:06 Taxable amount in Box 2 of the tax form 1099R.

09:07 When do you have to have withholding on 1099R?

10:36 Retirement plan contributions by taxpayers.

12:14 Distribution codes in Box 7 on 1099R.

13:24 Exceptions to 10% Penalty on early retirement plan distributions.

17:01 Roth IRA withdrawal rules.

17:37 State information on 1099R.

18:49 Qualified Charitable Distribution (QCD).

The 15 Most Common Tax Forms in 2022 (+Infographics) article: / 15mostcommontaxformsin2022

Boost Your Tax IQ Book: shorturl.at/ijBU2

Form 1099R boxbybox instructions: https://boostyourtaxiq.com/resources

IRS instructions for 1099R are at https://www.irs.gov/pub/irspdf/i1099...

——————————DISCLOSURE———————————

The information presented in this video is for informational and educational purposes only. It is not intended to render tax advice for any specific situation. Those needing assistance with a specific situation should consult with a qualified Tax Professional.

The information in this video is based on current tax law and IRS regulations as of date of publication and is subject to change.

#taxguide101 #akistepinska