What is a 1099R?

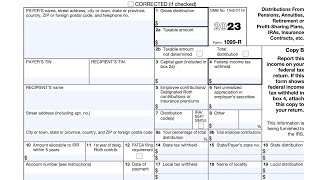

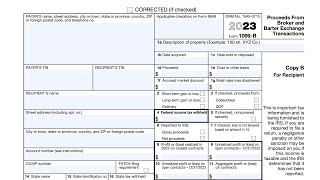

The 1099R Form is one of several forms in the 1099 series. These forms are provided whenever you receive money from a retirement plan or annuity. But you don't have to be retired to get one.

This video is a rundown of what's on a 1099R Form and how the different numbers on the form affect your tax liability.

Related Videos:

IRA 101: IRA Distributions: • IRA 101: Traditional IRA Distributions

IRA 101: Rollovers: • IRA 101: Rollovers

IRA 101: Roth IRAs: • A guide to Roth IRAs

Early Withdrawal Penalties and how to avoid them: • Early Retirement Distribution Penalti...

Additional resources:

IRS Form 1099R: https://www.irs.gov/pub/irspdf/f1099...

Instructions for Form 1099R: https://www.irs.gov/pub/irs.pdf/i1099...

IRS Publication 590B: "Distributions from Individual Retirement Arrangements": https://www.irs.gov/pub/irspdf/p590b...

Ascensus.com: "IRS Form 1099R Box 7 Distribution Codes": https://thelink.ascensus.com/articles...

The Tax Geek on Twitter: @taxgeekusa

The Tax Geek on Reddit: www.reddit.com/r/askataxgeek

Intro and background music: “Bluesy Vibes” Doug Maxwell YouTube Audio Library

DISCLAIMER:

The information presented in this video is for informational and educational purposes only, and is not intended to render tax advice for specific situations. If you have questions about your specific tax situation, please consult the resources linked above or consult with a qualified tax professional in your community.

The information contained in this video is based on tax law and IRS regulations as of the date of publication, and may be subject to change.